Assessor

Josh Morgan, Assessing Division Supervisor

Carla Hill, Assessing Division Manager 616.846.8262

Assessing services are provided through a contractual agreement with Ottawa County. Ottawa County Equalization Director Brian Busscher serves as the City Assessor. Assessing Division Manager Carla Hill is the primary point of contact and is available at City Hall on Wednesday mornings from 8:00am to 12:00pm, or by appointment. The Ottawa County Assessing Division can be reached at 616-846-8262 during customary business hours. Please see the contact accessibility policy for more information.

The office sets values on over 6,000 properties in the City. This is done with sales ratio studies in order to maintain assessed values at 50 percent.

The office uses the fair market value to derive a property’s:

- Assessed value (half the true cash value)

- State equalized value (S.E.V.), which is usually, but not always, the same as the assessed value

- Taxable value, along with the millage rate, is used to determine amount of property tax

The office takes various factors into account when establishing property value, including:

- Description of the property and its improvements

- Lot dimensions

- Age of home and/or other buildings

- Land value

- Building square footage

- Value-enhancing amenities

Public Information

Access to the following information is provided through the Assessor’s office:

- Name of registered owner of property at a particular address. May be an individual or a business.

- A property’s tax roll description, assessed value, and S.E.V.

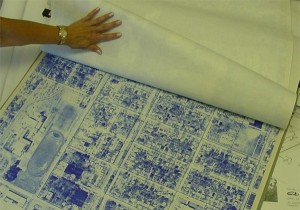

- Maps of City parcels. The maps give the location of property designated by specific parcel numbers and a diagram of property configuration.

You can also access this information online using:

Ottawa County Equalization Department

City of Grand Haven Assessment Data

State of Michigan Property Tax Estimator

Levy Rates

Land Valuation & Economic Condition Factors

The valuation of land and calculation of economic condition factors are performed annually by the assessor’s office. These rates and factors are integral to quality assessments and are used to adjust assessments to the local market.

Land Valuation & Economic Condition Factors

Special Assessments

Special assessments questions should be direct to the Treasurer’s office. Their amount is determined in the Treasurer’s office, and records of whether assessments are due or delinquent are kept there. The Assessor’s office can give some information as to the initial figures on which the assessment was based (square footage, etc.)

Tax Abatements

The Assessor’s office determines assessed value, S.E.V., and taxable value of property for tax abatements.

Forms

Forms are available on the forms page. Please download pdf file, print, complete, and return to the Assessor’s Office.